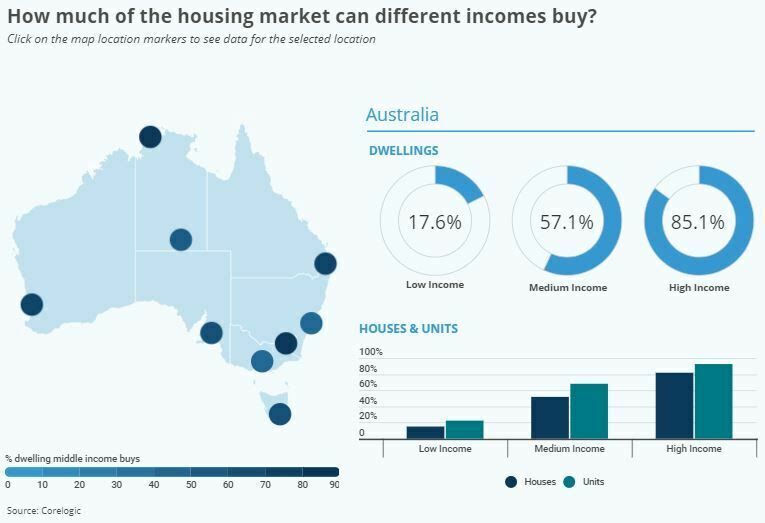

According to modelling from CoreLogic, people on low incomes could afford to buy little more than 1 in 6 properties in Australia, while those on middle incomes could afford to buy almost 3 in 5.

Households on low incomes (at the 25th percentile) have an estimated weekly income of $905, which allows them to buy 17.6% of Australian dwellings.

Middle-income households (50th percentile) earn $1,654 per week and can buy 57.1% of homes.

High-income households (75th percentile) earn $2,760 per week and can buy 85.1% of homes.

CoreLogic assumed borrowers would spend a maximum of 30% of household income on mortgage repayments, put down a 20% deposit and take out a 30-year loan at 2.44%. That meant a maximum purchase price of:

* Low income = $376,041

* Middle income = $685,723

* High income = $1,144,715

If you are a mortgage broker, are these the kind of splits and numbers you’re seeing with your clients?

#mortgage #mortgages #loan #mortgagebroker #loans #homeownership #refinance #australia #people #property